Company Income Tax Rate 2018 Malaysia

Year assessment 2017 2018.

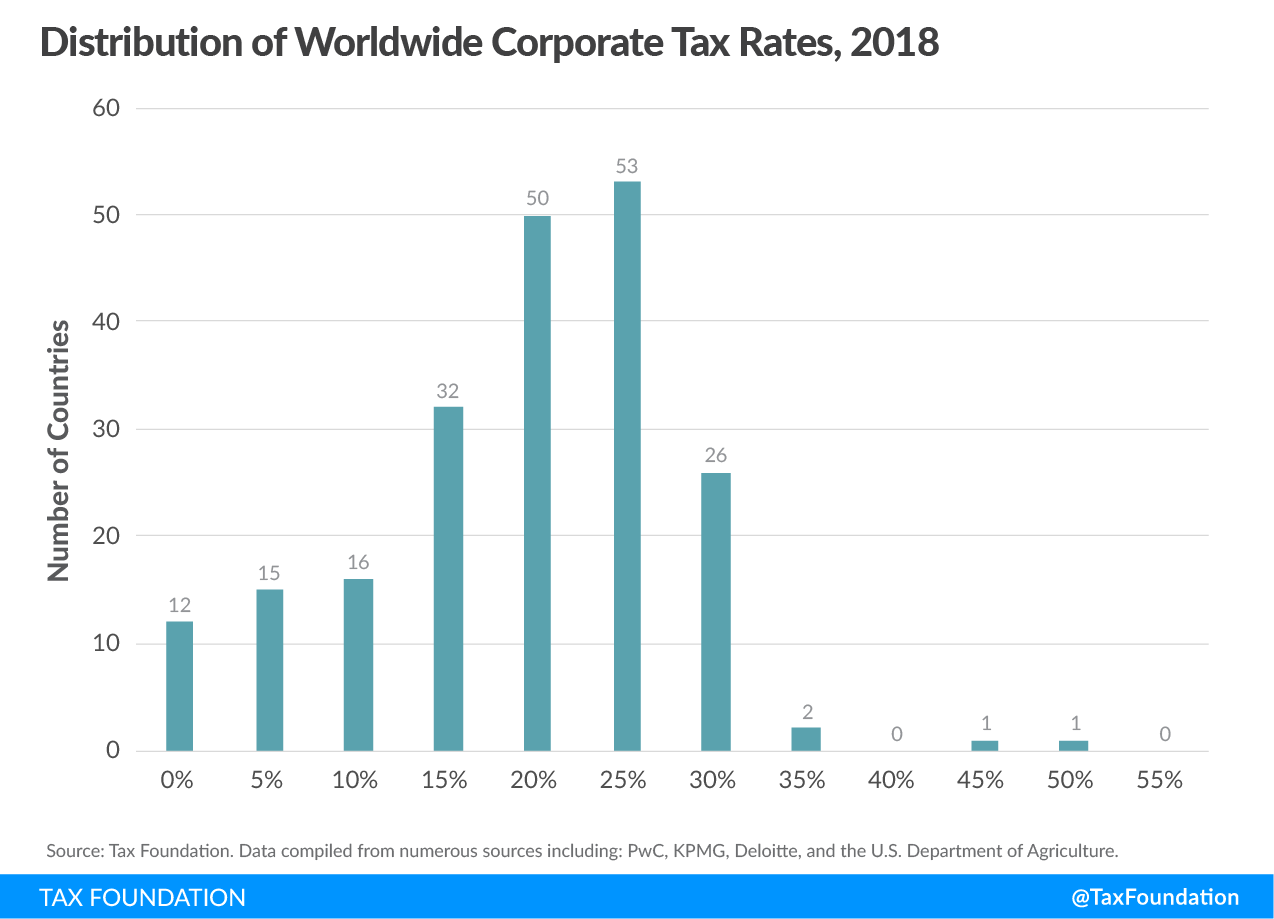

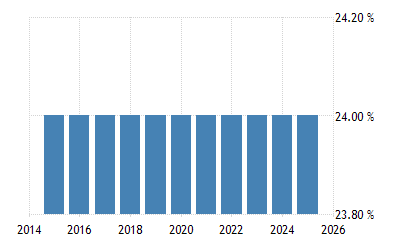

Company income tax rate 2018 malaysia. For both resident and non resident companies corporate income tax cit is imposed on income accruing in or derived from malaysia. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. Rate the standard corporate tax rate is 24 while the rate for resident small and medium sized companies i e. Companies capitalized at myr 2 5 million or less and that are not part of a group containing a company exceeding this capitalization threshold is 18 on the first myr 500 000 with the balance taxed at the 24 rate.

Tax rm 0 5 000. This page is also available in. Jadual average lending rate bank negara malaysia seksyen 140b sekatan ke atas kebolehpotongan faedah seksyen 140c akta cukai pendapatan 1967 edisi bahasa inggeris sahaja study group on asian tax administration and research sgatar. Melayu malay 简体中文 chinese simplified malaysia personal income tax rate.

Chargeable income myr cit rate for year of assessment 2019 2020. Here are the tax rates for personal income tax in malaysia for ya 2018. A company whether resident or not is assessable on income accrued in or derived from malaysia. You don t have to pay taxes in malaysia if you have been employed in the country for less than 60 days or for income that is earned from outside malaysia.

Companies incorporated in malaysia with paid up capital of myr 2 5 million or less and that are not part of a group containing a company exceeding this capitalization threshold is 18 on the first myr 500 000 with the balance being taxed at the 24 rate. Company with paid up capital not more than rm2 5 million. On the first 5 000. The standard corporate tax rate is 24 while the rate for resident and malaysian incorporated small and medium sized companies smes i e.

Company with paid up capital more than rm2 5 million. Understanding tax rates and chargeable income. For year of assessment 2018 the rates for lower brackets earners have been decreased from 5 to 3 10 to 8 and 16 to 14 for the year of assessment 2018. These new rates will apply for those who have accumulated their income from january 2018 to december 2018 and are filing their taxes from march april 2019.