Income Tax Rate In Bangladesh 2019 20 Pdf

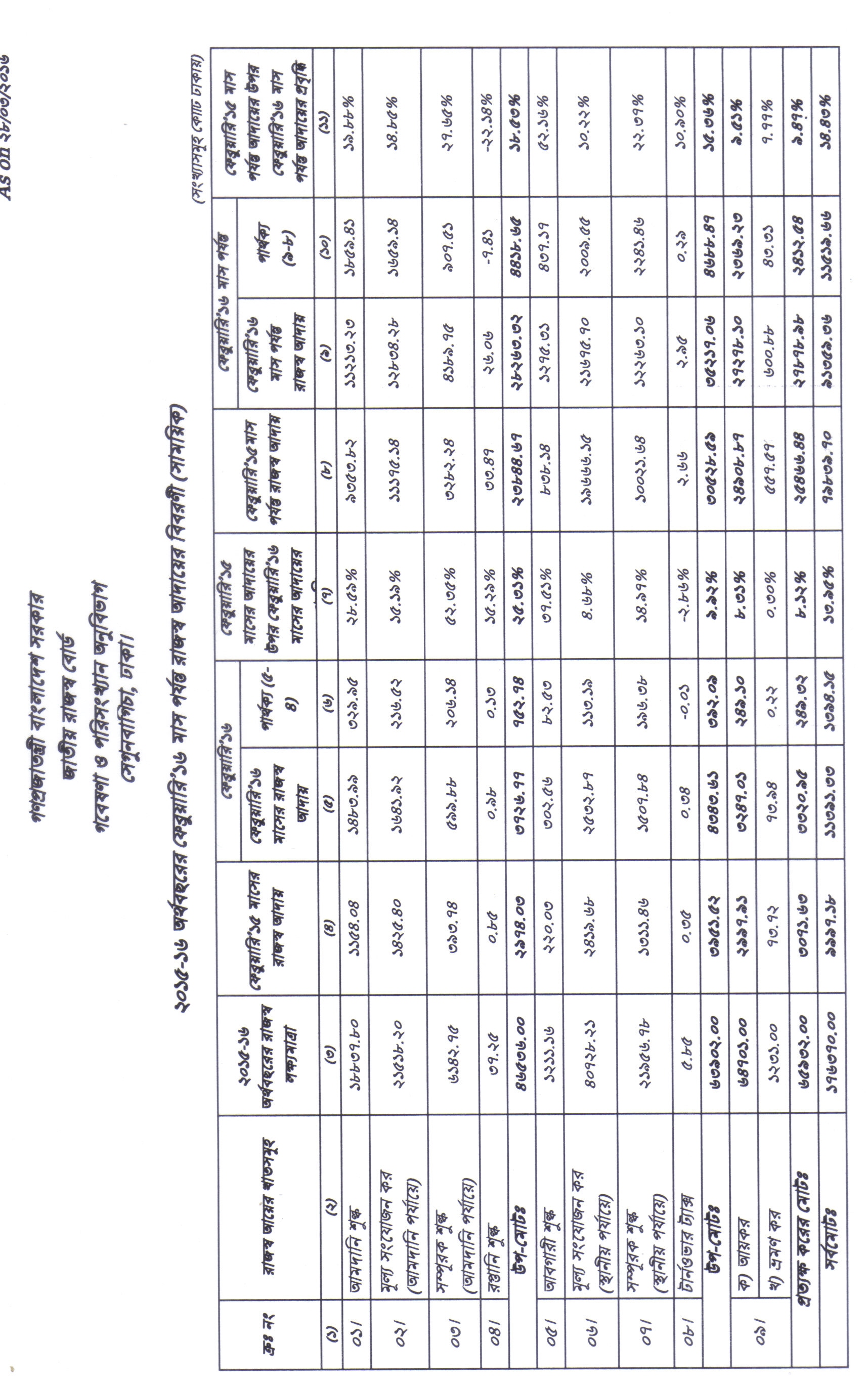

The amount of income tax target in fy2019 20 is 33 49 percent of the total tax target of tk.

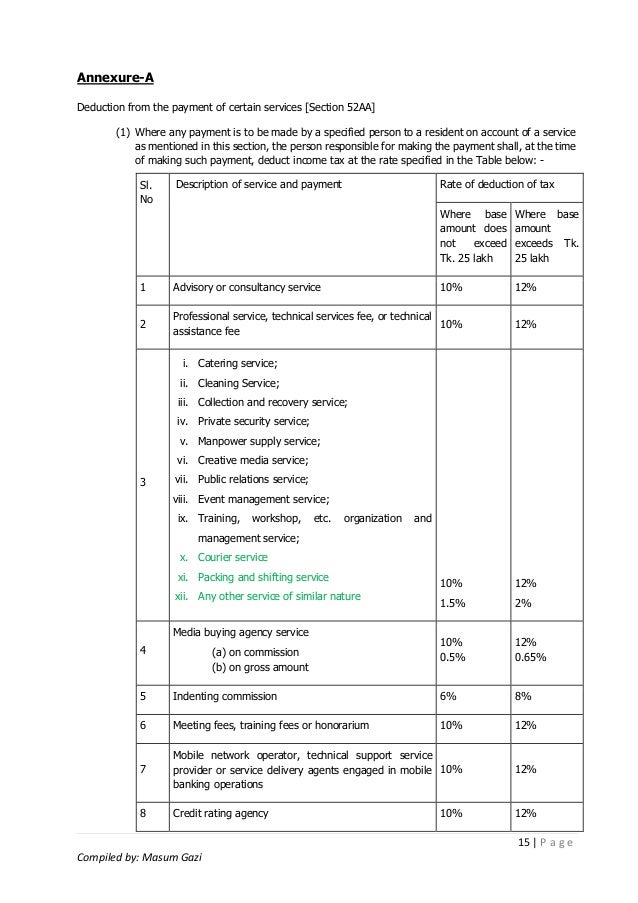

Income tax rate in bangladesh 2019 20 pdf. In brief the changes are discussed here and the details have been presented below in the table. Company tax rate 113 table 4. Tds rates in bangladesh for 2019 2020 few changes have been noticed in the tds rates in the financial year 2019 20. Revenue collection scenario in last ten years 112 table 2.

It aims at ensuring equity and social justice. So for more details you may. The national board of revenue nbr is the apex authority for tax administration in bangladesh. 5 00 000 5 5 rs.

10 00 000 30 30 surcharge. Sectoral allocation in budget 106 table 7. 325 600 crore and 30 15 percent of the total revenue excluding foreign grants target of tk. And for your help we have also included an explanation in annexure.

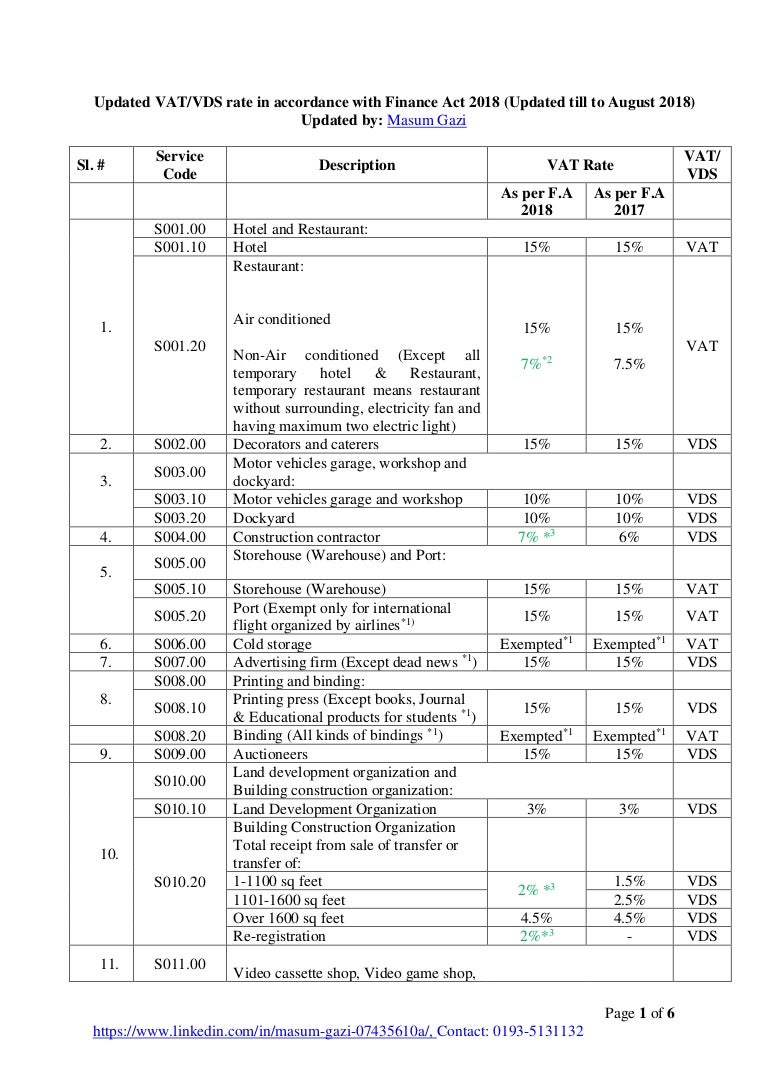

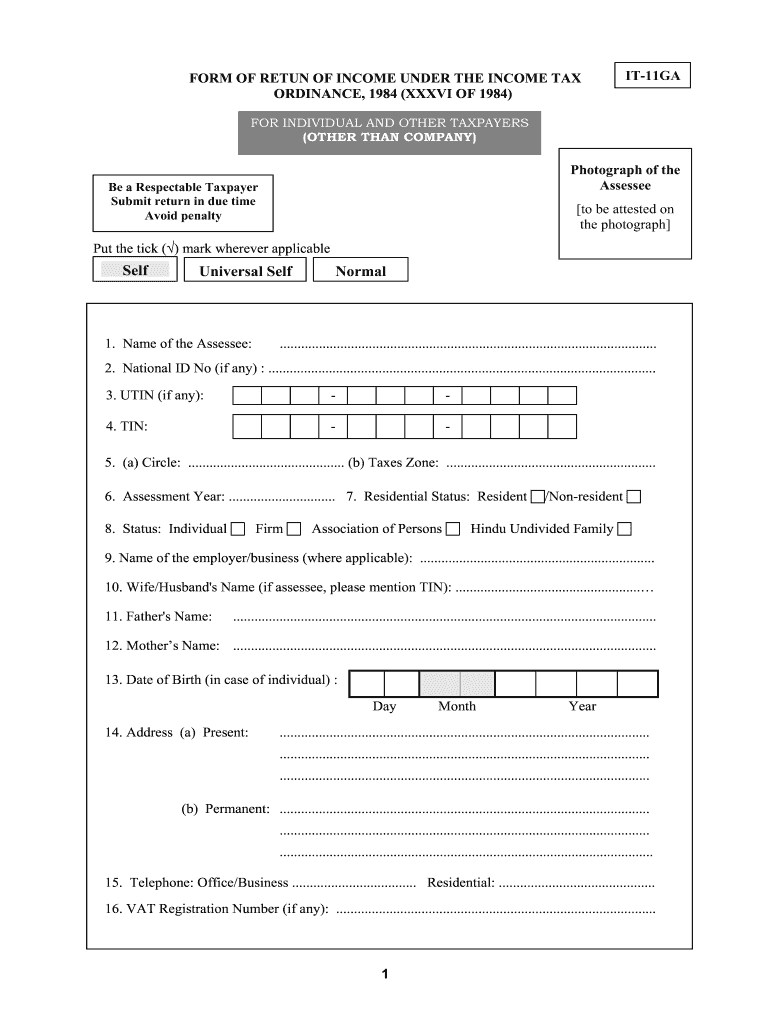

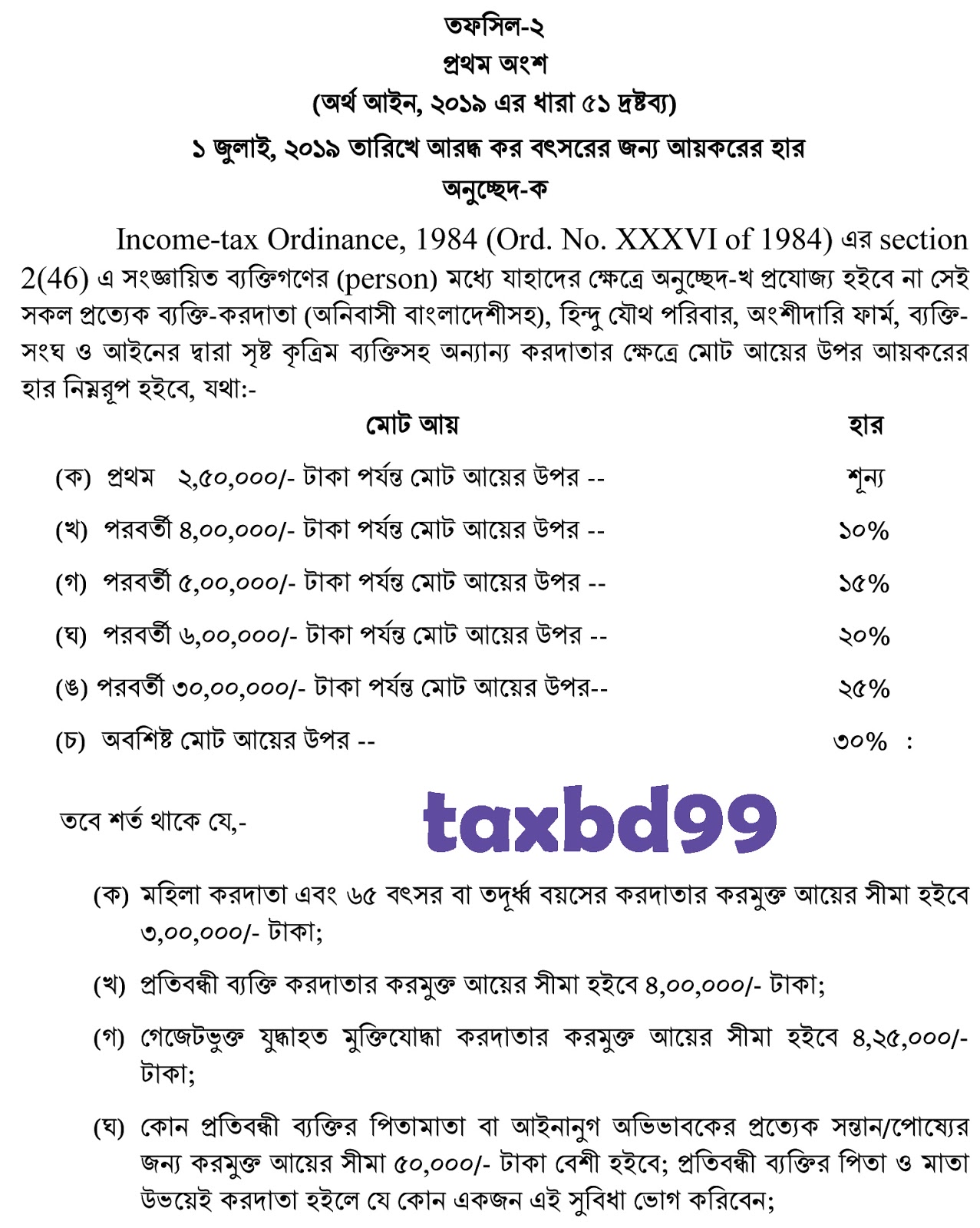

Pdf on feb 1 2017 rehana ismail published value added tax vat in view of bangladesh find read and cite all the research you need on researchgate. 340 100 crore 34 99 percent of the nbr s tax target of tk. Allocation for fy 2019 20 105 table 6. In bangladesh income tax is being administered under the tax legislations named as the income tax ordinance 1984 xxxvi of 1984 and income.

The tds rates will be 3 where base amount does not exceed bdt 25 lakh but 4 where base amount exceeds bdt 25 lakh. The national board of revenue nbr is the apex authority for tax administration in bangladesh. Income tax is imposed on the basis of ability to pay. Government of the people s republic of bangladesh national board of revenue income tax manual part 1 the income tax ordinance 1984 xxxvi of 1984 as amended up to july 2014 published by deputy director bangladesh forms publication dhaka printed by deputy director bangladesh government press dhaka 2014.

10 00 000 20 20 above rs. Tax rates for taxpayers other than companies 112 table 3. It was established by the father of the nation bangabandhu sheikh mujibur rahman under president s order no. It was established by the father of the nation bangabandhu sheikh mujibur rahman under president s order no.

The more a taxpayer earns the more he should pay is the basic principle of charging income tax. Ministry division wise budget allocation 108 annexure b table 1. Net income range rate of income tax assessment year 2021 22 assessment year 2020 21 up to rs. Under section 52q the rate of tds is 10 from any income in connection with any service provided to any foreign person by a resident person.