Tax Rate 2018 Malaysia

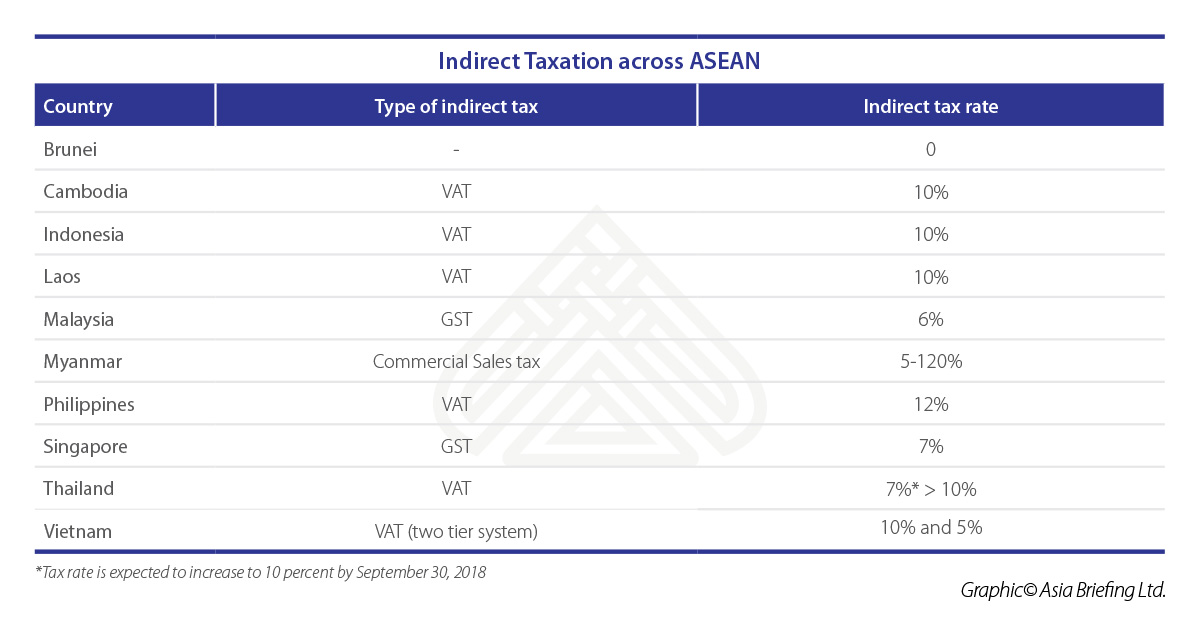

Malaysia is to reintroduce its sales and services taxes sst from 1 september 2018 with a likely standard rate of 10.

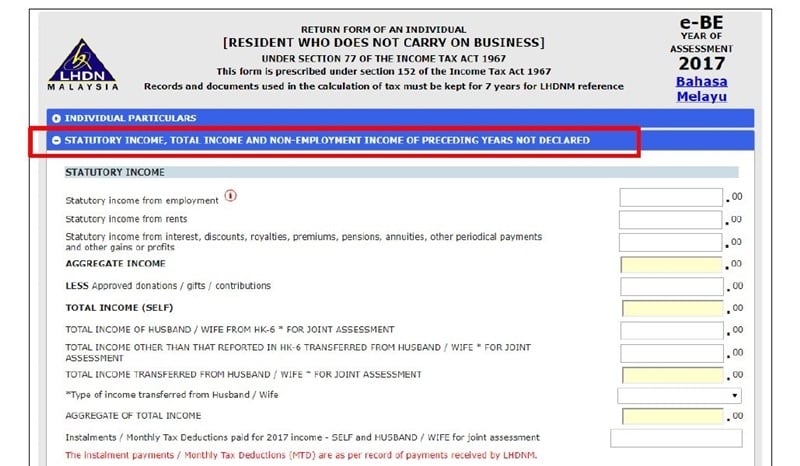

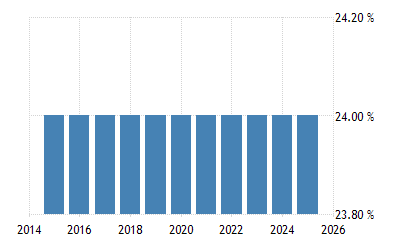

Tax rate 2018 malaysia. 2018 2019 malaysian tax booklet 23 an approved individual under the returning expert programme who is a resident is taxed at the rate of 15 on income in respect of having or exercising employment with a person in malaysia for 5 consecutive yas. Malaysia personal income tax rate is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a max of 28. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in malaysia. What is the treatment for importation of big ticket items for upstream petroleum activities.

No other taxes are imposed on income from petroleum operations. Gst is charged at standard rate of 0 on the part of work performed until 31 august 2018. For year of assessment 2018 the rates for lower brackets earners have been decreased from 5 to 3 10 to 8 and 16 to 14 for the year of assessment 2018. Calculations rm rate.

On the first 5 000. Income tax rate malaysia 2018 vs 2017. Green technology educational services. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g.

These new rates will apply for those who have accumulated their income from january 2018 to december 2018 and are filing their taxes from march april 2019. For assessment year 2018 the irb has made some significant changes in the tax rates for the lower income groups. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. Tax rm 0 5 000.

Semua harga di atas akan dikenakan cukai perkhidmatan malaysia pada 6 bermula 1 september 2018. All prices in malaysian ringgit rm myr all price above will subject to malaysia service tax at 6 commencing 1 september 2018. Not only are the rates 2 lower for those who has a chargeable income between rm20 000 and rm70 000 the maximum tax rate for each income tier is also lower. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields.